Have you ever heard of the word air miles or loyalty points? Probably through some distant relative of yours or that ever-traveling friend who brags that he/she travels around the world for free, or maybe from some popular influencer who has a ton of followers and is always traveling first class on some of the world’s best airlines having the choicest of champagnes and caviar. If not, we’re here to demystify the world of air miles, which will empower you to fly to an international or domestic destination in business class or take your family on that long-awaited Europe trip at a fraction of a cost or just simply help you choose the best way to fly where your vacation would start even before you reach the destination.

What are Air Miles?

Air miles or simply called miles (also referred to as points by some airlines) are loyalty points earned while flying a particular carrier. These loyalty points work in a somewhat similar way to store loyalty points, wherein, you register and create an account under your name, and every time you shop, the store gives you a certain credit in the form of points, which can then be used in future to buy new clothes.

Now if we apply a similar logic to air miles, almost every major international airline has a loyalty program (referred to as a Frequent Flyer Program – FFP), wherein, the airline rewards air miles to its flyers whenever they fly on airlines flights or its partner flights mostly based on distance traveled or money spent, in turn, these miles can be used to redeem flights or to buy items from affiliate shopping portals (which may not be the best use for the same). For example, Singapore Airlines has its own FFP known as KrisFlyer, United Airlines has MileagePlus, Vistara has Club Vistara, etc.

Why should you care about air miles and their uses?

Historically the only way of earning air miles was through flying a particular airline multiple times during a particular period (say a calendar year). The number of air miles earned varies depending on the price of the ticket, type of class traveled (economy/business/first), distance flown, etc.

However, as luxury travel becomes more popular through the years, airline companies realized that the market for FFPs is huge, and a lot of them formed separate divisions (heck even separate companies, some of which are also profitable😉 remember jet privilege now intermiles ) to manage their programs which now come up with various promotions, partner affiliations, etc.

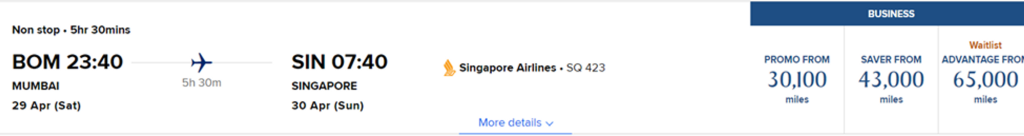

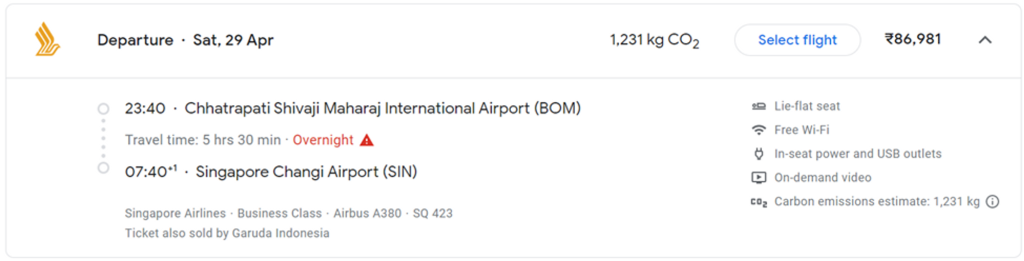

While one might think that they don’t fly so often to derive any benefit out of these FFPs, here’s where the real fun starts, and credit cards come into play. What if I say that you could fly from Mumbai (BOM) to Singapore (SIN) (per person one way) for ~30,100 KrisFlyer miles in Business class, where the same ticket would set you back a whopping ~₹ 87,000. And this is just the cherry on the cake, the entire cake is that one could theoretically earn those points in just 1 month even without stepping foot on an airplane.

How to earn airmiles in India?

Remember I mentioned before that FFPs are a huge business in themselves? Also, some of them are profitable. One of the most important ways in which FFPs make money is by entering into partnerships with banks. While countries in which credit card business is at a very mature stage (especially the US), the partnerships have been running for quite a while. For ex., Citi bank in the US has a partnership with American Airlines (AA), wherein they offer a co-branded credit card through which one can earn credit card rewards in the form of miles.

However, Indians have historically been wary of credit cards, where every household has at least one person who would convince you that it’s an inevitable debt trap. Given this mindset, Indian banks did not have plenty of reasons to provide their customers with a ton of good credit card options which gave them an opportunity to earn substantial rewards.

But things are changing fast. As the spending on credit cards has grown exponentially over the past few years, so has the plethora of credit card offerings. The credit card companies have realized that customers are no longer satisfied with just a basic cashback card (wherein one gets a certain % of rewards as a form of cashback in their credit card statements) but need air miles/hotel transfer partners which would enable one to stay in that swanky 5-star hotel or enjoy that aspirational business/first class flight.

Just in the past year, we’ve seen credit card companies up their game by offering credit cards with an option to transfer their reward points to various FFPs/ hotel loyalty programs. There are also co-branded cards such as Axis Vistara Infinite, Air India SBI Signature, SBI Etihad Guest, etc. which enable you to earn air miles directly for that particular brand. The best cards are those which give you the flexibility of multiple transfer partners, which in turn helps in keeping redemption options quite open.

Best Credit Cards for Airmiles in India

Axis Bank Magnus Credit Card

Inarguably the talk of the town amongst all the credit card enthusiasts for the past year, and for all the right reasons (or at least for the most part).

- Joining fee – Rs.10,000 + 18% GST. Payment of joining fees provides the cardholder a choice to choose between a one-way complimentary domestic flight ticket or a Tata CLiQ voucher worth Rs.10,000.

- Renewal fee – Rs.10,000 + 18% GST. Payment of renewal fees would provide the same benefits as that of joining fee. No renewal fee on spends of Rs. 15 lacs or more in a year.

- Reward rate – 12 EDGE points for every Rs. 200 spent (or in multiples of Rs. 200). EDGE points can be converted into air miles at a ratio of 5:4 (which effectively translates into 4.8 air miles for every Rs. 100 spent).

- Airline transfer partners – AirAsia, Air France, KLM, Vistara Air, Ethiopian, Etihad, Singapore Air, Qatar Airways, Spicejet, Turkish Airlines, United Airlines, Air Canada, Japan Airlines, Qantas, and Thai Airways – with more expected to be added.

Unique benefits:- 25,000 bonus EDGE points on spends of ₹ 1,00,000 or more in a calendar month.

- 5X EDGE points for flights/hotel bookings through the Axis Travel Edge booking portal.

- 5X EDGE points for shopping on partner websites through the Axis Grabdeals portal (restricted to a maximum of 5,000 points in a calendar month).

- 3X – 10X points on shopping for gift cards/vouchers through the Axis Gyftr EDGE rewards platform (no cap on points earnings).

- Unlimited domestic lounge access for primary and add-on card holder/s.

- Unlimited international lounge access through Priority Pass for primary cardholders along with 8 additional guest visits.

- 8 airport concierge (meet & greet) services in a calendar year.

- Target audience – This card is a no-brainer for those who have spends north of ₹ 1,00,000 in a month. The card can also be very beneficial for people who’re able to hit the monthly milestone even for 6 out of 12 months, especially if combined by using Axis Gyftr or Grabdeals portal for accelerated reward points.

- Eligibility criteria – Salary of Rs. 18L per annum or Annual IT return filed for Rs.18 lacs.

- Bonus tip: This card can also be applied via an offline agent on a card-to-card basis if you have an existing credit card with a limit of Rs. 4 lacs.

Axis Bank Atlas Credit Card

A no-nonsense card that adds more value as you spend. Axis has implemented a spend-based tier, wherein, the cardholder is receives additional benefits on achieving the given tiers.

- Joining fee – ₹5,000 + 18% GST. Payment of joining fees would entail the holder a joining bonus of 5,000 EDGE Miles. These miles can be converted to air miles in a ratio of 1:2 (which effectively translates into 10,000 air miles).

- Renewal fee – ₹5,000 + 18% GST. Kindly refer to the table below for details on the renewal bonus.

- Reward rate – 2 EDGE Miles for every ₹100 spent.

- Airline transfer partners – AirAsia, Air France, KLM, Vistara Air, Ethiopian, Etihad, Singapore Air, Qatar Airways, Spicejet, Turkish Airlines, United Airlines, Air Canada, Japan Airlines, Qantas, and Thai Airways – with more to come.

Unique benefits:

- 5 EDGE Miles for flights/hotel bookings through the Axis Travel Edge booking portal.

- 5 EDGE miles on using the card when booking directly through hotel and airline websites/apps.

- The USP of this card lies in its tiers. The more one spends, the more EDGE miles and benefits it unlocks.

Here is a simple table explaining the different benefits of all the 3 tiers:

| Benefits/Tiers | Silver | Gold | Platinum |

| Spends Required | 0 | 7.5L | 15L |

| Milestone Benefit | 2500 Edge Miles on spending 3L | Additional 5000 Edge Miles | Additional 10000 Edge Miles |

| Renewal Benefit | 2500 Edge Miles | 5000 Edge Miles | 10000 Edge Miles |

| Domestic Lounge Access | 8 | 12 | 18 |

| International Lounge Access | 4 | 6 | 12 |

| Airport Meet&Greet | 0 | 2 | 4 |

| Airport Transfer | 0 | 0 | 2 |

- Target audience –

- For someone who has a high spending pattern but the expenses are scattered over the year, hence achieving the monthly bonus for Magnus won’t be possible;

- Also, it is a great card to supplement Magnus for additional spends above Rs. 1 lac in a month; and

- For those who have high direct hotel and airline spends.

- Eligibility criteria – Net annual income of ₹9L for salaried and ₹12L for self-employed.

- Bonus tip: This card can also be applied via an offline agent on a card-to-card basis if you have an existing credit card with a limit of Rs. 3 lacs.

Axis Bank Reserve Credit Card

The crème de la crème card in Axis’ portfolio.

- Joining fee – ₹50,000 + 18% GST. Upon payment of the annual fee you get a welcome bonus of 50,000 EDGE points. These points can be converted into air miles in a ratio of 5:4 (which effectively translates into 40,000 air miles).

- Renewal fee – ₹50,000 + 18% GST. Payment of renewal fees provides the same benefits as that of the joining fee. No renewal fee on spends of ₹25L or more in a year.

- Reward rate – 15 EDGE points for every ₹200 spent.

- Airline transfer partners – AirAsia, Air France, KLM, Vistara Air, Ethiopian, Etihad, Singapore Air, Qatar Airways, Spicejet, Turkish Airlines, United Airlines, Air Canada, Japan Airlines, Qantas, and Thai Airways.

Unique benefits:

- 2X EDGE points on forex transactions bundled with a low forex markup of 1.5% + 18% GST.

- 5X EDGE points for shopping on partner websites through the Axis Grabdeals portal (restricted to a maximum of 5,000 EDGE points in a calendar month).

- 3X – 10X EDGE points on shopping for gift cards/vouchers through the Axis Gyftr platform (no cap on points earned).

- Complimentary Accor Plus membership which provides 2 complimentary nights in select hotels in Asia Pacific along with hotel-specific discount vouchers for dining and stays (renewed every year).

- 8 complimentary airport concierge services in a year.

- 4 complimentary luxury airport transfer services in a year.

- Unlimited domestic lounge access for primary and add-on cardholders along with 12 additional guest visits.

- Unlimited international lounge access for primary and add-on cardholders along with 12 additional guest visits.

- Club ITC Culinaire membership and Club Marriott Asia Pacific membership which provides dining and stay discounts (renewed every year).

- 50 Complimentary golf rounds every year across select golf courses in India.

- Target audience –

- For high net-worth individuals (HNIs)/Ultra HNIs who don’t mind paying generous joining/renewal fees. However, that said, the joining fees is pretty much paid off in the 1st year through 40,000 air miles and 2 complimentary nights in Accor hotels;

- High forex spenders;

- For someone who wants to keep things simple as this is the only card in our list that gives 6% back in air miles as a base reward rate

- For those who enjoy staying in 5-star hotels frequently

- Could enjoy the golf benefits.

- Eligibility criteria – Although Axis doesn’t publish the eligibility criteria openly, the card can be applied via an offline agent on a card-to-card basis if you have an existing credit card with a limit of Rs. 6L. People with a burgundy account or higher can also apply for the card through their relationship manager, however, approval would be subject to internal approvals based on the value of their banking relationship.

HDFC Bank Infinia Credit Card

The undisputed king of credit cards till last year. This card ruled the roster for over a decade till Axis Magnus came into the picture.

- Joining fee – ₹12,500 + 18% GST. Payment of joining fees would provide 12,500 points.

- Renewal fee – ₹12,500 + 18% GST. Payment of renewal fees would provide the same benefits as that of the joining fee. No renewal fee on spends of ₹10L or more in a year.

- Reward rate – 5 points for every Rs. 150 spent.

- Airline transfer partners – Air Canada, British Airways, Etihad, United Airlines, AirAsia, Avianca, Finnair, Air France, KLM, Hainan Airlines, Vietnam Airlines, Vistara, Singapore Air, Vistara, and Turkish Airlines.

- Points redemption – This has been kept as a separate category for Infinia and HDFC Diners Black as there are multiple ways to redeem your points.

- Redemption through the SmartBuy portal for hotel/flights booking and Tanishq vouchers/Apple products in a ratio of 1:1, where every point has a value of Rs.1. Please note that only 70% of the amount can be paid via points while redeeming through SmartBuy portal;

- Transfer points to air miles in a ratio of 1: 0.5 (where every point would fetch 0.5 air mile) for Air Canada, British Airways, Etihad, and United Airlines, and 1:1 for all other partner airlines; and

- Statement credit at a value of Rs. 0.3 for every point.

Unique benefits:

- 3X – 10X points on the HDFC SmartBuy portal where one can shop through affiliate partner websites (Flipkart, Amazon, etc.), buy gift vouchers, and make hotel/ flight bookings. Please note that the accelerated rewards are capped at 7,500 points per day and 15,000 points per month.

- Unlimited airport lounge access across the globe for primary and add-on card holders.

- Stay benefits and 1+1 buffet offers at participating ITC hotels.

- Unlimited complimentary golf rounds every year across golf courses in India and select golf courses across the globe.

- Complimentary Club Marriott Asia Pacific membership for the 1st year which provides dining and stay discounts.

- Target audience – The card has been heavily devalued over the past year which makes offerings from Axis better. That said, the card has been around for over a decade and has been continuously providing great rewards. This will be a great card for:

- Those who’re already in the HDFC ecosystem. Existing cardholders should continue to hold the card as they would be in a great position to upgrade once HDFC comes up with an offering above Infinia

- Excellent card for those who don’t have a high spending pattern but have enough to meet the monthly accelerated threshold points target through the SmartBuy portal; and

- Even for Axis cardholders, this card would help in diversifying the air miles earning and burning opportunities through different partner airlines.

- Eligibility criteria – Although HDFC advertises this card as an invite-only, there are certain criteria through which users have been able to apply/upgrade to this card successfully. Some of them are

- Net monthly salary of Rs. 3 lacs

- Existing HDFC card limit of Rs. 8-10 lacs with spends in a similar range in the past 6 months

- People with an Imperia account or higher can also apply for the card through their relationship manager. However, approval would be subject to internal approvals based on the value of the relationship.

HDFC Bank Diners Black Credit Card (DCB)

DCB used to be a darling amongst credit card enthusiasts as the eligibility criteria were not as strict as Inifinia, and also for the fact that it provided almost the same benefits as Infinia before the devaluations started kicking in last year.

- Joining fee – ₹10,000 + 18% GST. Payment of joining fees would provide cardholders with annual memberships of Club Marriott Asia Pacific, Forbes India, Swiggy One (3 months), Amazon Prime, MMTBlack, and TimesPrime Smart on spending ₹1.5L within 90 days of card issuance.

- Renewal fee – ₹10,000 + 18% GST. No renewal fee on spends of Rs. 5 lacs or more in a year. Cardholders would receive the same benefits as that of the joining fee subject to the spending of Rs. 8 lacs or more in the previous year.

- Reward rate – 5 points for every ₹150 spent.

- Airline transfer partners – Air Canada, British Airways, Etihad, United Airlines, AirAsia, Avianca, Finnair, Air France, KLM, Hainan Airlines, Vietnam Airlines, Vistara, Singapore Air, Vistara, and Turkish Airlines.

- Points redemption – This has been kept as a separate category for Infinia and DCB as there are a few ways to redeem your points:

- Redemption through the SmartBuy portal for hotel/flights booking and Tanishq vouchers/Apple products in a ratio of 1:1, where every point has a value of Rs.1. Please note that only 70% of the amount can be paid via points while redeeming through SmartBuy portal;

- Transfer points to air miles in a ratio of 1: 0.5 (where every point would fetch 0.5 air mile) for Air Canada, British Airways, Etihad, and United Airlines, and 1:1 for all other partner airlines; and

- Statement credit at a value of Rs. 0.3 for every point.

Unique benefits:

- 2X – 10X points on the HDFC SmartBuy portal where one can shop through affiliate partner websites (Flipkart/Amazon), buy gift vouchers, and make hotel/flights booking, etc. Please note that the accelerated rewards are capped at 2,500 points per day and 7,500 points per month.

- Cardholders can select any 2 benefits amongst cult.fit Live 1-month membership/BookMyShow/ TataCLiQ/Ola cabs vouchers worth Rs. 500 every month on spends of Rs. 80,000.

- Unlimited airport lounge access across the globe for primary and add-on card holders.

- 6 complimentary golf rounds every quarter across golf courses in India and select golf courses across the globe.

- 2X points for dining in any restaurant on weekends (restricted to 1,000 points per day).

- Target audience – The card is a sub-par offering when compared to Infinia with lower caps on accelerated reward points through SmartBuy. The card may also have acceptance issues at merchant outlets since the card is issued on Diner’s platform vs Visa/Mastercard platform used for Infinia. We suggest applying for/holding this card if:

- Someone is looking to upgrade their existing DCB to Infinia or take benefits of different airline transfer partners

- Frequent travelers in need of unlimited lounge access

- Issued as a lifetime free (LTF) card (please see the bonus tip below)

- Eligibility criteria – Salary of Rs.1.75 lacs per month or Annual IT return filed for Rs.21 lacs.

- Bonus tip: This card can also be applied via an offline agent on a card-to-card basis if you have an existing credit card with a limit of Rs. 5 lacs. The card is also issued as an LTF card for individuals who are alumni of a select list of institutes as updated by HDFC from time to time.

Amex Platinum Charge

American Express’ top offering is just below the elusive Centurion Card. This card focuses on individuals who’re used to a certain lifestyle rather than those geared toward earning maximum rewards.

- Joining fee – ₹60,000 + 18% GST. Payment of joining fees would provide cardholders with a joining bonus varying from 100,000 – 125,000 Membership Rewards (MR) points or ₹45,000 – ₹55,000 Taj vouchers.

- Renewal fee – ₹60,000 + 18% GST. The renewal bonus varies on a case-to-case basis as per Amex’s internal criteria.

- Reward rate – 1 MR point for every Rs. 40 spent.

- Airline transfer partners – Cathay Pacific, British Airways, Emirates, Etihad, Qatar, Singapore Air, Vistara, and Virgin Atlantic. MR points can be transferred to partner airlines in a ratio of 2:1, where 2 MR points would fetch 1 air mile. The only exception is Vistara, where 3 MR points would fetch 1 air mile.

Unique Benefits

- 5X points on partner websites and gift vouchers through the Amex Reward Multiplier platform.

- 3X points on forex spend.

- Unlimited domestic and international lounge access to primary and supplementary cardholders via domestic lounge partners, Centurion lounges, Priority Pass lounges (only applicable for primary and 1 supplementary card holder), and Delta Sky Club lounges.

- Complimentary Taj vouchers worth ₹10,000 in your birthday month. Only applicable for primary card holders.

- Complimentary Taj vouchers worth ₹30,000 for domestic travel bookings of ₹100,000 or above. The booking should be made through the Amex call center.

- International airline program which offers preferential airfares on Air France, Etihad, Japan Airlines, KLM, Qatar, Singapore Air, United Airlines, and Virgin Atlantic.

- Fine Hotels and Resorts (FHR) – is Amex’s in-house hotel booking platform which provides users similar benefits like Hyatt Prive’, Marriott STARS, etc., where one would get elite-like perks on booking luxury hotels such as free breakfast for two, one category room upgrade, guaranteed late checkout, $100/$50 in hotel credits, etc.

- 25% off on Taj Hotels and 50% off on Oberoi hotel suites.

- Elite status in the form of Marriott Bonvoy Gold, Hilton Honors Gold, Radisson Rewards Gold, and Hertz Gold plus awards.

- Amex Platinum “Do Anything” Concierge that can help in securing that obscure India vs Pakistan cricket match ticket to last-minute gift arrangements for your wife’s birthday which you conveniently forgot.

- Target audience – Those who like to live life king size and rewards is a 2nd priority. Although the elite statuses of Marriott, Hilton, and Radisson are not the highest tier, one may derive value from them if they’re frequent visitors. This card can make sense if one has an upcoming redemption planned and is able to secure 1.25 lacs MR points as a joining bonus. The card would then pretty much pay itself back for the 1st year.

- Eligibility criteria – Salary of Rs.25 lacs per annum or Annual IT return filed for Rs.15 lacs for self-employed.

Amex Platinum Travel

The best card in the American Express portfolio in my opinion. This is a no-frills card that will be the most rewarding on spending Rs. 4 lacs in a year.

- Joining fee – (1) ₹3,500 + 18% GST. Welcome gift of 10,000 MR points

- Renewal fee – ₹5,000 + 18% GST. The renewal bonus varies on a case-to-case basis, however, most users are able to get either a spends-based reversal of renewal fees; or 10,000 – 15,000 MR points subject to internal approvals and upon achieving decent spending in the past year.

- Reward rate – 1 MR point for every Rs. 50 spent.

- Airline transfer partners – Cathay Pacific, British Airways, Emirates, Etihad, Qatar, Singapore Air, Vistara, and Virgin Atlantic. MR points can be transferred to partner airlines in a ratio of 2:1, where 2 MR points would fetch 1 air mile. The only exception is Vistara, where 3 MR points would fetch 1 air mile.

Unique benefits:

- Bonus 40,000 MR points on achieving spends of Rs. 4 lacs, wherein, 15,000 bonus points would accrue on spending Rs. 1.9 lacs and the rest 25,000 MR points would accrue upon reaching the spend milestone of Rs. 4 lacs. These MR points could be either transferred to airline transfer partners or redeemed for a Taj voucher worth Rs. 0.5 for every 1 MR point.

- Complimentary Taj voucher worth Rs. 10,000 on achieving Rs. 4 lacs spend milestone.

- 2 complimentary domestic lounge access per quarter.

- Target audience – This is a great card for beginners who’re ready to enter into the air miles game. You don’t have to worry about inclusion/exclusions like every other bank as all spending would count towards milestone benefits. This card could also be a great complimentary card to your existing Magnus/Infinia as the MR points can be transferred in a 1:1 ratio to Marriott Bonvoy, which would provide you free hotel stays.

- Eligibility criteria – Salary of Rs.6 lacs per annum or Annual IT return filed for Rs.6 lacs for self-employed.

Closing comments

This is a lot of information to comprehend and we don’t expect our readers to consume it in a single go. Rather, one should let the information seep in over a few reads, and let this article be a quick reference guide for future needs.

For those who’re new to credit cards or air miles game in general, we recommend taking baby steps by enrolling for a simple credit card like an Axis Atlas or Amex Platinum Travel and then slowly gaining knowledge about different FFPs depending on their travel patterns/ redemption aspirations.

Meet “Jetsetter” Parthak, a 22-year-old coding maestro and tech wizard by day, and luxury travel aficionado by night. Harnessing the power of credit card points and air miles, he transforms everyday transactions into first-class globetrotting adventures. Between architecting digital masterpieces and jet-setting across the world, Parthak is living proof that pixels and passport stamps are the perfect blends for a high-resolution life.

How long does it take to transfer HDFC Points?

JAL Mileage Bank – The Ultimate Guide for Indians

Miles for Dummies: Family Pooling

Etihad Business Studio Review – Is the lost mojo back?

Miles for Dummies: Family Pooling

Best Credit Cards to Buy Apple Products in India

Etihad Business Studio Review – Is the lost mojo back?

Introduction to Timatic – All Your Visa Questions Answered